Welcome to Turnover Tax

If your business’s annual turnover is less than R1 million, you could be missing out on significant tax savings. The Turnover Tax structure, implemented by SARS, is designed to:

- Lower your tax rate

- Reduce compliance and admin burdens

- Provide affordable, simplified tax solutions

A Brief History of Turnover Tax

Turnover Tax was introduced by the South African Revenue Service (SARS) in 2009 as part of a broader initiative to support and simplify tax compliance for small businesses. Designed specifically for micro-enterprises with an annual turnover of R1 million or less, this system was created to reduce the administrative burden and costs associated with traditional income tax. Instead of taxing profits, Turnover Tax applies to a business’s gross income, using a simplified flat-rate structure. This eliminates the need for complex accounting, provisional tax, VAT, capital gains tax, and dividends tax for qualifying businesses. SARS implemented this system to encourage the formalisation of small businesses, increase compliance, and make it easier for entrepreneurs to operate within the legal tax framework. For many small business owners, Turnover Tax offers not only administrative relief but also significant financial savings.

Tax Savings Over Time

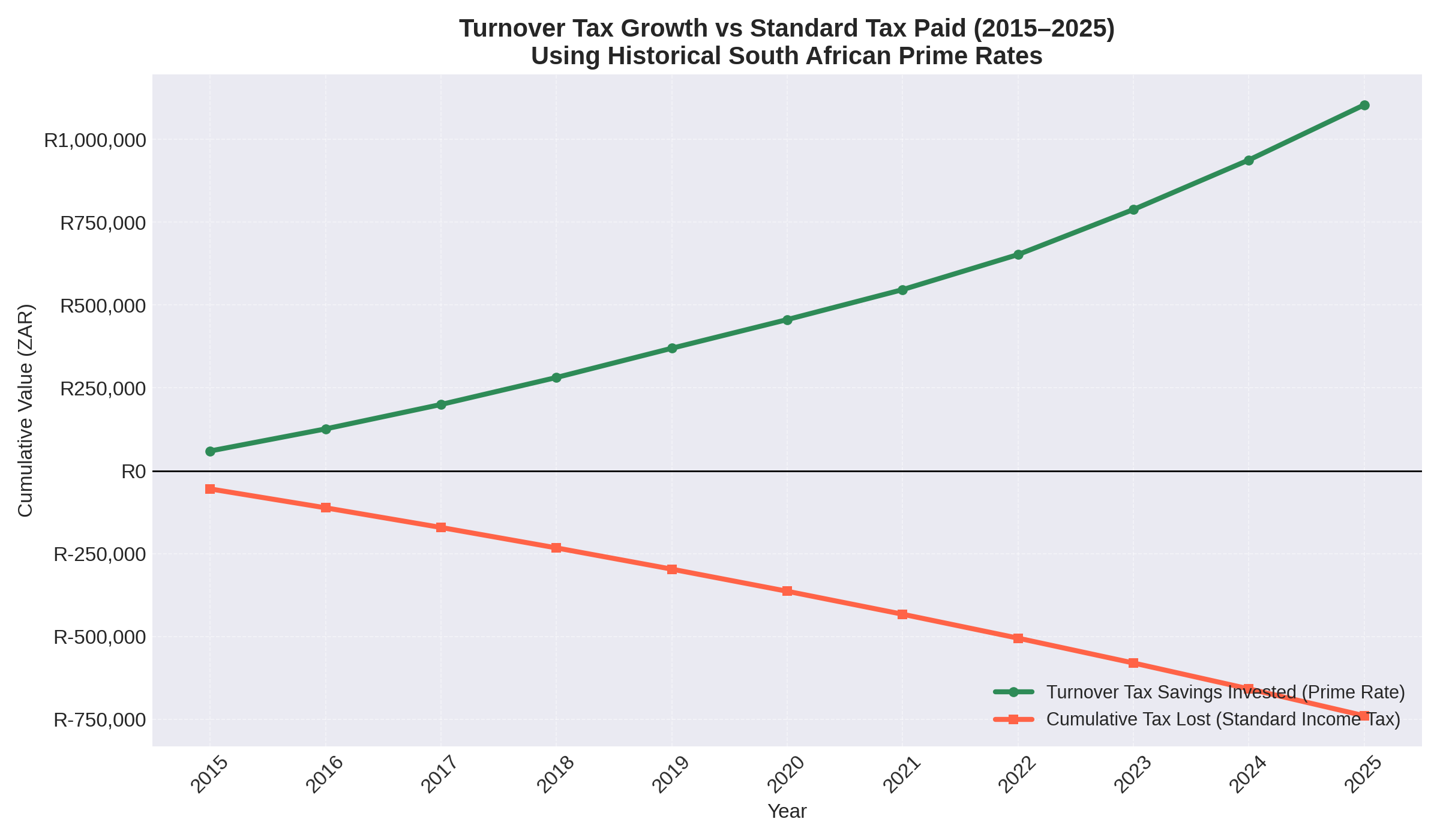

This graph compares two business owners over 11 years:

🟢 The green line shows how money grows when a business owner uses Turnover Tax and reinvests the savings at the Prime Lending Rate — what South African banks charge top customers.

🔴 The red line shows the total tax paid in the standard system — money that's lost over time with no return.

Over 11 years, the difference becomes massive — proving that smart tax planning is a powerful wealth-building tool.

Historical Prime Rates (2015–2025)

From 2015 to 2025, South Africa’s prime rates have fluctuated between approximately 9.0% and 11.5%. These rates indicate the cost for top-tier borrowers and were used here to calculate the growth of reinvested tax savings, demonstrating the potential financial benefits of switching to Turnover Tax.

Check Your Eligibility

If you think you may qualify for Turnover Tax, leave your details below and we’ll be in touch to help you get started.